NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

We’ve Seen This Movie Before!

By: David Moenning, Heritage Capital Research

Published: 8.5.24

Markets are selling off hard around the world. The press will have you believe the move is due to Friday’s jobs report and fear of recession. In my humble opinion, this is absolutely NOT the case. No, this move is all about Japan and the Yen-Carry Trade…

Bad News is Bad Again

By: Paul Schatz, Heritage Capital LLC

Published: 8.5.24

For all those crying for a rate cut, thinking it would just propel risk assets higher, bad economic news is now bad news for the markets. Those folks are dead wrong…

Protecting The Downside

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 7.26.24

We have rotated out of Technology and reduced our NASDAQ holdings in most of our portfolios. Unlike Tech, however, the S&P500 still looks ok as a core for now. If the market doesn’t reverse course soon, we will start putting up more defenses to protect from further downside.

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Fundamentals Board , which is designed to be a summary of key external factors that have been known to drive stock prices on a long-term basis.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

Fed Holding Rates Too High?

By: Rob Bernstein, RGB Capital Group

Published: 8.5.24

The Fed has raised interest rates

to restrict the economy and bring down high inflation that resulted from massive monetary stimulus and deficit spending.

Historically, the Fed often holds rates too high for too long, pushing the economy into a recession. We are starting to see indications that this might be the case this time around as well….

Stocks in Correction

By: Craig Thompson, President Asset Solutions

Published: 8.2.24

In my last two newsletters, “Narrow Market Breadth” and “Stock Market Internals Are Deteriorating Rapidly,” I highlighted significant technical weaknesses within the stock market, particularly narrowing market breadth. This condition warned that the stock market was becoming increasingly susceptible to a correction even though major market indexes were advancing…

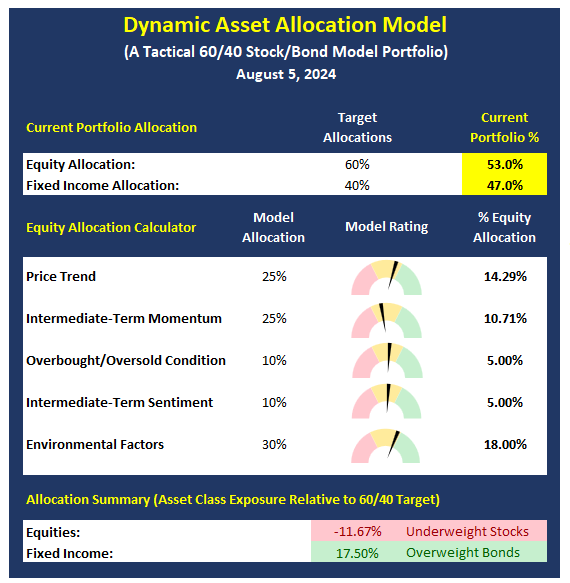

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Market at Critical Juncture

By: Bo Bills Bills Asset Management

Published: 8.2.24

The bull market is still alive and while not well at least alive. How the market settles next week will give us much more information…

Buy Low and Sell High?

By: Will Hepburn ShadowRidge Asset Management

Published: 7.26.24

The Great American Investment Creed of “buy low and sell high” sounds so simple, but it must be very hard to do on a consistent basis, or we would all be a lot richer. To buy a stock like Amazon early on and get rich is the American dream. But it is not very realistic. Sure, it is doable, but very, very hard to actually do in real life. ..

Market Insights

By: Ben Reppond Reppond Investments

Published: 7.31.24

Ben Reppond’s latest video reviews the status of the stock market today…

Time To Manage Risk!

By: Dexter P. Lyons Issachar Fund

Published: 8.5.24

The Friday jobs report was substantially worse than expected, and the market concluded that we are headed for a possible crash landing instead of a soft landing. We could be in all-cash position on Monday if our markets follow the lead of the overseas stock markets as the risk of recession increases. The futures markets predict an ugly open on Monday morning, so I expect stocks to fall further…

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

Click To See the Current Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stock market, Stock Market Analysis, stock market, David Moenning, Heritage Capital Research, Paul Schatz, Heritage Capital LLC, Rob Bernstein, RGB Capital Group, Ryan Redfern, Shadowridge Asset Management, Sam Bills, Bo Bills, Bills Asset Management, Dexter Lyons, Issachar Fund, Jim Lee, Stratfi, Craig Thompson, Asset Solutions, William Hepburn, Asher Rogovy, Magnifina, Ben Reppond, Reppond Investments, NAAIM Exposure Index, NAAIM Dynamic Allocation Model