NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

What Will It Take?

By: David Moenning, Heritage Capital Research

Published: 07.11.22

It is worth noting that the stock market “action” has been a bit better of late. As in, there weren’t any sudden, violent declines that appeared out of nowhere last week. But the key question at this stage of the game is, what will it take to get the bears to head back into hibernation?

Staving Off Recession, For Now

By: Paul Schatz, Heritage Capital LLC

Published: 07.11.22

Markets seem to be in the good news is bad news regime as a stronger economy means more inflation and a more aggressive Fed. For all those declaring the US is or has been in recession, this mortally wounds that argument. While employment data is usually the last to fall, this report clearly says that the fall did not happen nor start just yet.

Recession Will Follow When…

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 06.24.22

The Federal reserve is now admitting that we may be heading towards a recession. We have been saying it seemed likely for quite a while now. They’ve been behind on raising rates for over a year, so now it seems like they are playing catch-up. The last domino to fall, in our opinion, is when we see a shift to higher unemployment. Then recession should soon follow.

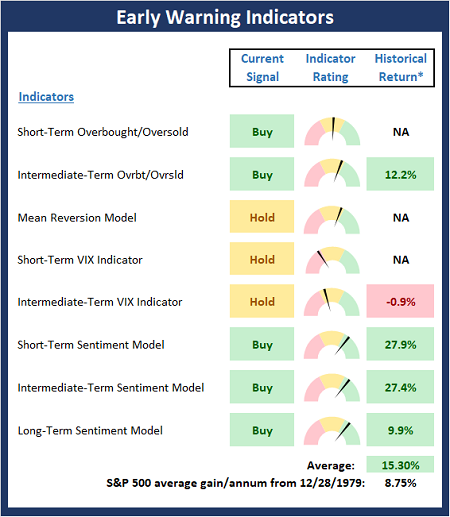

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 07.11.22

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Warning Board , which is designed to suggest when the market may be ripe for a reversal on a short-term basis.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

Nothing Has Changed (Yet)

By: Rob Bernstein, RGB Capital Group

Published: 07.11.22

The S&P 500 Index, as well as most of the major stock market indices, staged strong rallies since mid-June. The index was up 6.3% since June 16th but that rally did little to change the overall trend. In short, there is no indication that the current bear market decline is over and market risk remains elevated…

Bears Firmly In Control

By: Craig Thompson, President Asset Solutions

Published: 07.04.22

Market technicals started to become bearish in Q1 – Q2 of last year. Since then, market technicals have continued to deteriorate and major market indexes rolled over at the beginning of this year. Today, I’ll summarize the different technical categories that have helped us to anticipate the market downturn and how they look currently….

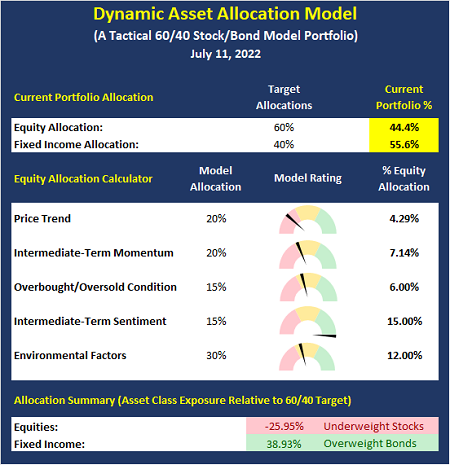

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Watching and Waiting

By: Sam and Bo Bills Bills Asset Management

Published: 07.08.22

While the markets have drifted up a bit this week, the story remains much the same. The Fed tightening is a huge headwind for the market to weather. Throw in what is expected to be weaker earnings and

cautionary forecasts and it becomes much more than a headwind! Absent a 180 from the Fed or a cease fire in Ukraine, it is

hard to imagine the market continuing to go up much further than the above resistance levels…

Risk Remains Elevated

By: Dexter P. Lyons Issachar Fund

Published: 07.11.22

My perception of risk is still high as NASDAQ 100 has rallied into its 50-DMA line of resistance on light volume. Nothing has changed, nor do I see it changing, so I expect the market to drift sideways to down in this trendless market. Anything can happen, and I stand ready to change my opinion if fundamentally strong stocks set up properly…

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model